Cash flow Management

Cash flow management (CFM) is the process of tracking how much money is coming into and going out of a business. CFM helps us to always know how much cash will be available. Additionally, CFM provides crucial information to the business on how much inflow is needed to cover costs such as employee salaries, loan installments, and supplier invoices. These inflows, on a regular basis, come from sales.

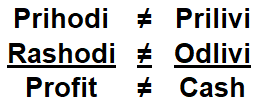

"Revenues are not inflows, expenses are not outflows, profit is not cash" are the three main facts of CFM. Inflows represent collected revenues, outflows occur when we pay for something, and the difference between inflows and outflows is the actual cash we have. Unlike the actual cash balance in bank accounts, profit represents the result achieved by the company over a certain period, regardless of whether revenues are collected or expenses are paid. This leads us to two key aspects of cash flow management:

- Expected inflows from the company's operational activities

- Working capital management

Expected inflows from the company's operational activities represent the forecasted results of the company in a future period, considering the credit policy towards customers and suppliers. The most important parameter of this aspect of cash flow management is EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization.

Working capital management is the process that enables efficient use of the company's working capital. This is ensured by effectively managing customers, inventory, and suppliers. Therefore, the most important elements of working capital management are customer collections, inventory turnover, and payments to suppliers.

What does Cash Flow Management bring?

It brings stability. Companies can go bankrupt even when they have achieved profits, have good products, and provide good services. The only assurance that can guarantee stable and healthy growth is cash flow management. CFM also allows for the best use of free funds and the lowest capital costs for your company.

Cash flow management provides:

- Security in ensuring you won't run out of money.

- Sufficient cash to keep the business running smoothly.

- Timely payment of all expenses, especially employee salaries.

- Optimal cash available for investment.

- The ability to take advantage of additional cash discounts on purchases.

- Avoidance of unplanned expensive loans.

Problems:

Without good cash flow management, companies face a range of problems, such as: tion with banks and business partners.

- Daily uncertainty regarding the cash the company has. Accounts are always strained, and every transaction depends on another.

- Goods/materials are ordered based on available cash rather than sales activities.

- Many additional costs due to unplanned ordering.

- Lost sales opportunities.

- Constant pressure and conflicts among sales, finance, and procurement departments.

- Use of suboptimal financing sources.

- Loss of reputation with banks and business partners.

The role of AIM Institute

AIM Institute successfully works on establishing effective Working Capital Management (WCM). Whether there is no existing WCM or an existing CFM that you are not satisfied with, AIM provides support in designing a perfectly optimal process using the best global practices.

Implementation segments:

- Employee involvement: Implementation always includes employees. On one hand, it focuses on training and developing the cash flow management holders, while on the other hand, it communicates with all other employees about their role in cash flow management.

- Establishing a sales plan and operational revenue planning with elements of credit policy.

- Working on inventory management.

- Working on the payment process to suppliers.

- Rad na procesu plaćanja prema dobavljačima.

- Software integration: Implementation includes software. The complexity of the software varies, and the choice of software exclusively depends on the company's needs.